One of the best ways to keep your finances in check is to be organized. For some people, organization comes naturally but for others, not so much. You may have seen those pretty financial/budget binders on Pinterest and thought it takes way too much time to be that organized. I hear you. But never fear: we’ll start with a much smaller task so you can be on your way to better budgeting!

Before you even begin to think about budgeting, you need to know what bills you have each month and when they are due. Even if you don’t have a budget created yet, this is the beginning to getting your finances organized.

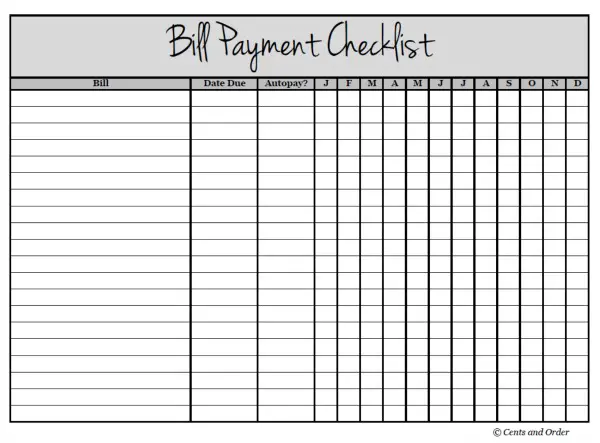

Knowing what bills you have and when they’re due will give you the main information you have to have in order to create a budget. I like to keep track of my bills on a little form called a Bill Payment Checklist.

The Bill Payment Checklist form is simple go-to form that will list all of your bills and give you a way to remember what needs to be paid – and when. It will also provide you a quick overview of what bills you have upcoming and a way to track your payments.

Table of Contents

Late Payments Can Cause Trouble

Using some type of system to keep track of and to pay your bills is important for a couple of reasons. The first is that using a system that works for you will make life less stressful. The second reason is that when you don’t pay your bills on time, you can be setting yourself up for trouble.

As an example, one day, I received a phone call that one of my bills was late. For me, that’s a big deal – I am pretty meticulous with my finances. But imagine if a lack of a bill paying system resulted in you getting reminder calls from creditors on a regular basis.

There’s something about getting calls from creditors that can be a little intimidating. In my case the missed payment was simply a lack of being organized. It had been a busy couple of weeks in our household and I figured that with all the chaos, I just missed the bill.

So I went back through my files plus the papers on my desk looking to find the bill. And guess what? I didn’t have it. It must have gotten lost in the mail. But the right bill paying system could’ve helped me get the bill paid on time even though I hadn’t received the actual statement in the mail.

Even if you are great about paying the bills when they come in, what happens if you don’t get the bill? Using a Bill Payment Checklist will remind of you of all your bills – even if the bill gets lost.

Creating a Bill Payment Checklist

Using the Bill Payment Checklist form we’ve created here at Cents and Order is simple. I think you’ll like it so much that once you start using it you won’t want to track bill payments any other way. Here’s how it works.

Figure out the due dates

Gather up all your bills. I recommend gathering all of your statements or using a scratch piece of paper for this step as you organize your bills. For automatically paid bills, you may need to check your accounts online. As you go through each bill, list each bill and also the day of the month it is due on a piece of notebook or scratch paper.

List the amount

Depending on your preferences, you may want to include the amount of the payment on your bill payment checklist. You can include the actual amount for recurring bills that are the same each month. For bills that vary, you can put an estimated or average amount.

Transfer to the Bill Payment Checklist

Once you have all of your bills listed out on scratch paper, you’ll want to transfer the information onto your Bill Payment Checklist. Fill in your Bill Payment Checklist from your scratch paper list, making sure to list the bills in due date order. The checklist will be more beneficial to you if you keep them in order.

For stationary payment amounts you can fill in the amounts on the Bill Payment Checklist for the entire year. For fluctuating payment amounts you can fill in the payment amount as you get new statements.

Tell me it’s not great having a snapshot of all upcoming bills due in one place! With one glance, you can see what’s due, when it’s due and how much you need to pay.

As you pay each bill for the month, simply put a check mark in the month’s initialed box to remind yourself that you’ve already paid the bill.

Using the Checklist

Now that you’ve got your Bill Payment Checklist filled out, it’s important to keep the list where you will see and use it. Where you keep it will depend on what will best keep near the front of your mind.

That might be in a financial binder, printed and on the fridge, or on a bulletin board. Not only will the list help you see what you’ve paid and what you’ve got left to pay, it will also show you, at a glance, what expenses are coming due soon.

This will help you avoid mistakes like the one I made when I missed paying that store card bill. If I’d had the Bill Payment Checklist then, I’d have realized the payment was due and would have caught that I hadn’t received the statement. Then I could’ve paid the bill online or by calling the card’s customer service center – on time.

Lesson Learned

Luckily the store card payment I made late was only a few days late, but the $25 late charge plus interest had already been tacked on to my bill. (It was a store card I use for discounts and pay in full when I use it). A call to customer service did get me a refund of the late charge, but the damage can be much worse if you pay your bills late.

Late payments can cause big and/or expensive trouble for you, such as:

- Expensive late fees charged by the creditor

- Interest charges you wouldn’t normally have to pay if you pay the card in full every month

- Increased interest rates (some creditors will increase your interest rate on the card if you make a late payment)

- Damage to your credit if you pay the bill more than 30 days past the due date

- Higher interest rates on other loans due to changes in your credit rating

As you can see, keeping track of your bills with a Bill Payment Checklist can avoid embarrassment and save money in unexpected charges.

Free Printable Bill Payment Checklist

Here’s a snapshot of our Bill Payment Checklist. Notice how easy it is to use.

Click here to download the Bill Payment Checklist today. It’s our free gift to you for being a Cents and Order reader. And now that we’ve got that settled, here are some other budgeting tips that will help you gain more control over your finances.

Try Tracking Your Spending

Along with having an organized chart showing when all of your bills are due, consider using a system to track your spending. Tracking your spending can be life changing because it will reveal all of those nickel and dime expenditures that can add up to big cash over time. Think daily coffee stops and drive thru runs.

It doesn’t take much more than a simple Excel spreadsheet to track your daily spending. However, a Personal Capital account will make it easier to do so. If you pay for all expenses using either a debit card or credit card, Personal Capital can give you an at-a-glance picture of your spending for the month. It divides each expense into proper categories such as transportation, entertainment, etc.

Tracking your spending can be life-changing in that it can give you a very clear analysis of where your money is going. Sometimes it seems as if you are “only spending” a bit here and a bit there. But those “bits” can add up to hundreds and even thousands of dollars over time.

Set Spending Limits

It can also be helpful to set spending limits in fluctuating cost categories. This is what a budget is truly about. Costs such as groceries, entertainment and discretionary spending (i.e. that random money you spend here and there) can get out of control fast.

If you set limits for those types of spending categories (i.e. “We’re only spending $500 per month on groceries) you can avoid spending more than you want to. Of course, this will take some planning as you work to ensure you don’t spend the month’s allotment within the first week of the month.

You may want to use envelopes to hold the cash for each category, each month. This practice will give you the visual reminder that you’re spending your hard-earned cash. Sometimes debit and credit card usage makes us forget that truth.

Just be sure that when the money for a given category has run out, you stop spending in that category. Avoid the temptation to spend money in one category by taking it from another category’s envelope.

In other words, if you run out of budgeted entertainment funds by the 10th of the month, don’t steal money from the grocery envelope to go see a movie.

Using disciplined techniques such as the ones above can be difficult to get used to – at first. However, many people find that knowing there’s a cap on fluctuating expenses makes money management more peaceful.

Without the fear of going over budget hanging over your head, you can better plan all aspects of your financial life. Investing, saving for retirement and paying off debt become easier. Budgeting and tracking spending ensure you can make a budget space for reaching your financial goals. Goals such as saving for retirement get priority. And as the months roll on you become more relaxed about your finances.

What do you think of our Bill Payment Checklist? What other techniques and tips do you use to budget effectively? Tell us in the comments section.